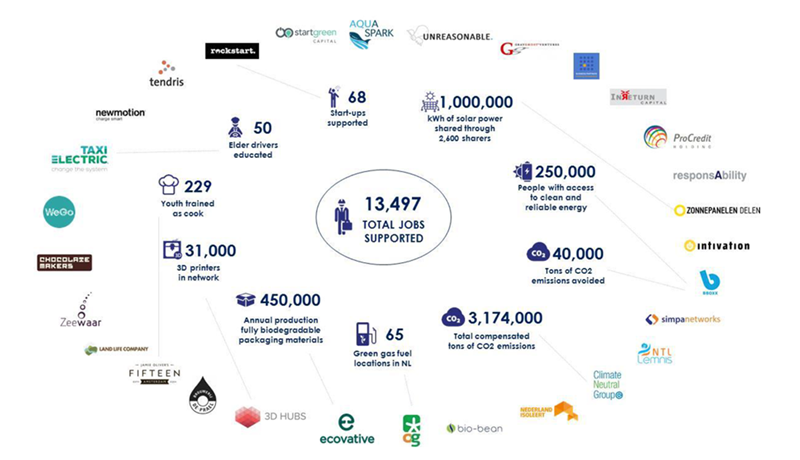

Financial impact

The companies in which DOEN Participaties invests have the potential to achieve financial results in addition to major social impact. The financial results are in the form of profits distributed to shareholders or an acquisition of shares by another company. In these cases, as a shareholder, DOEN Participaties will also recoup financial resources previously provided to achieve the social goals. And if a company is doing very well, this can be considerably more than was ever invested.

All these revenues remain within DOEN Participaties and are redeployed to achieve DOEN’s green or social objectives. This way the funds received can be used many times. This greatly increases the impact that DOEN can achieve. In addition to the green and social impact that DOEN has achieved with investments, DOEN’s investments have also resulted in significant returns on average. The many tens of millions of euros that DOEN has generated in this way have in turn given many new green and social initiatives a chance. And also, the funds received back can be bigger than the initial investment, providing DOEN with fresh financial resources to do its work.

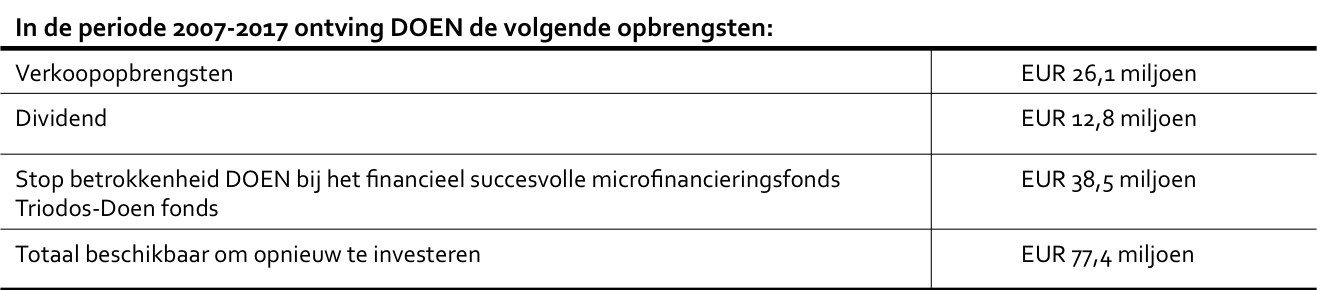

DOEN Participaties puts social benefits first, and takes great risks for these. Yet in spite of this, DOEN achieves very positive returns on its investments. In some cases, this high risk leads to a loss on the investment, but the successful companies more than make up for it. All proceeds are reinvested, so the portfolio grows organically. For example, in the period 2007-2017, DOEN received a total of more than €77 Million income from its investments (see below).